...

Announcement

Collapse

No announcement yet.

Bad beat/Moaning/Venting thread - Mammy told me not to come.

Collapse

This topic is closed.

X

X

-

So since 2008 both cities have enjoyed markedly greater growth than normal. When did quanatitive easing start again?Originally posted by Hitchhiker's Guide To... View PostHas quantitative easing being affecting London house prices for the last 40 years?

And presumably the good inhabitants of Amsterdam are on a 20-year quant easing free ride.

This is a capital city phenomenon. Everyone wants to live where all the cool amenities are and that means most people in a country can't actually afford to live there. Thats not realistically changing.

Comment

-

You can buy a 3 be house in Finglas for less than 200k, much less in some cases. All depends where you want to live.Originally posted by Hitchhiker's Guide To... View PostI see you missed the bit where I said "unless you own a house already". These are marginal effects. No biggie, but it does invalidate your entire point.

Plus your going to be sorely disappointed if you think property prices in Dublin are ever falling to a level where a €60k household is buying in Dublin. Thats just not the way it works.

Buying in a decent or better area though is very tough recently. 2011/12 was the best time by far this century to buy in terms of prices I'd say if you were in a position to.

Comment

-

Right now a few hundred couples who are earning €100k-€120k is probably enough to drive this market - the 500,000 households don't matter as 99% aren't moving anywhere and if they try to, unfortunately they probably can't remain in most areas in Dublin unless they are willing to compete with the aforementioned higher-income households.Originally posted by jack90210 View PostAnd you maintain the marginal effects will last forever?

That is, unless the supply situation changes. Though I'm doubtful about that, read another report yesterday of what sounded like a perfectly reasonably planning application to build 400+ apartments in three 14 story buildings in the industrial area of Sandyford get rejected, with the reason given they were out of characte or something! This is an ugly area awash with big buildings already, including a 14 story skeleton there since the boom.... bizarre. The only way we meet the housing demand is to build up, it seems to me. Think of all of the low-rise housing around the city centre, seems so out of place. Those social houses on the south side of the IFSC pedestrian bridge, for example.

Comment

-

The councillors in Dublin ought to be literally killed.Originally posted by ionapaul View PostThat is, unless the supply situation changes. Though I'm doubtful about that, read another report yesterday of what sounded like a perfectly reasonably planning application to build 400+ apartments in three 14 story buildings in the industrial area of Sandyford get rejected, with the reason given they were out of characte or something! This is an ugly area awash with big buildings already, including a 14 story skeleton there since the boom.... bizarre. The only way we meet the housing demand is to build up, it seems to me. Think of all of the low-rise housing around the city centre, seems so out of place. Those social houses on the south side of the IFSC pedestrian bridge, for example.

Comment

-

twin seats at the back are generally a lot colder. They are also near the toilets and galley, so noisey. On the plus side, the aisle is wider so less likely to be hit with the trolley, and no adjacent passengers wrecking your head.Originally posted by oleras View PostSeat selection.

I booked flight to Koh Samui.

4 flights with 2 planes, 3 legs on the 777-300 and 1 on the A380.

The twin seats near the rear of the 777 seem the optimum, but last for the food, obv paying a premium to not have to talk to anyone.

On the A380 we can go upstairs, again, twin seats.

I could just wait till 48hrs before and take the free allocation, but don't want to end up in the middle of the middle row !

What are peoples personal preferences ?

I'm usually 777/A380 flying to dublin depending on route and my preference is the middle section when flying in a couple. The middle section is 4 seat wide. So you have your two seats, the strangers have their two seats. You get in and out your side, then piss off out the far side. Nobody is climbing over anybody when they are sleeping, you don't have to let anyone out, or be asked to be let out etc.

Even if the middle section is only 3 wide on a narrow body, the same applies.

The 3-seat side sections are shit imo. The novelty of a window wears out after take off, and then you've got 12 hours disturbing someone to get out, or being disturbed every time the weirdo in seat A wants a piss.

Comment

-

100k dual income is 2 very ordinary jobs in Dublin. I would not consider it to be high earnings, comfortable and able to save a few quid was always middle class - thank you recession for deciding that everyone who isn't racking up credit card debt is a high earner.Originally posted by ionapaul View PostRight now a few hundred couples who are earning €100k-€120k is probably enough to drive this market - the 500,000 households don't matter as 99% aren't moving anywhere and if they try to, unfortunately they probably can't remain in most areas in Dublin unless they are willing to compete with the aforementioned higher-income households.

That is, unless the supply situation changes. Though I'm doubtful about that, read another report yesterday of what sounded like a perfectly reasonably planning application to build 400+ apartments in three 14 story buildings in the industrial area of Sandyford get rejected, with the reason given they were out of characte or something! This is an ugly area awash with big buildings already, including a 14 story skeleton there since the boom.... bizarre. The only way we meet the housing demand is to build up, it seems to me. Think of all of the low-rise housing around the city centre, seems so out of place. Those social houses on the south side of the IFSC pedestrian bridge, for example.

Fair enough if you living in the non galway or cork parts of the country you are doing really well but in Dublin its a very average existence.

That's 2 teachers, 2 average office drones, 2 civil servants, or 2 pretty low performing professionals in Law, IT, finance, accounting, medicine or a tradesman with a good reputation.

Mid thirty's has a lot of professionals earning 70k-80k - approx 10 years served. Every office block that isn't a call center is crammed with people earning over 50k. The nicer ones much more.

Pretty much every mid thirty's couple who go for brunch once a month, have one nice holiday and 2 city breaks a year and own a mid sized car less than 4 years old are earning over 100k in Dublin between them.

Comment

-

Window seats are key, can lean again the window and get a decent sleep.

Optimal strategy if there's two imo is booking the window and isle seat in 3-4-3 set ups, leaving the middle seat vacant. The middle seat will only be allocated if the plane is literally full, and in that case you can just swap the middle seat with either the window or isle with the stranger. Otherwise you get three seats between two.

Comment

-

Pish. Get a neck pillow and never look back. There's a reason old people use those things so much. It's because they are god tier.Originally posted by NewApproach View PostWindow seats are key, can lean again the window and get a decent sleep."I can’t find anyone who agrees with what I write or think these days, so I guess I must be getting closer to the truth." - Hunter S. Thompson

Comment

-

Wot Mellor said is bang on. There is a water dispenser near the last row of 4 on most 777s i have been on. Away from babies is good advice too. Both flights arent silly hours anyway, get a shower and lounge in dubai/abu dhabi and that improves the journey immensely. Deffo pick upstairs on A380 as wellLow fee Euro/UK money transfer, 1st transfer free through my referral

https://transferwise.com/u/bfa0e

Comment

-

- Short term, there will be ups and downs. But over any realistic timeframe, it'll be going up and up.Originally posted by carlop View Post- Do we think property prices in Dublin are going to continue to rise for the foreseeable future?

- Is buying a place the logical move everyone says it is, or am I being suckered into the false logic that 'rent is dead money'?

- I'd be buying solo - does this just put me at such a disadvantage to double income couples that it becomes -EV to buy?

- Rent is dead money. But there's plenty of dead money in buying. Taxes and fees associated with the sale, interest on the mortgage, bills you might not have been paying before etc.

- Having a single income doesn't affect the EV, you'll just have less money to play with.

I'm by no means an expert, but I'm a similar age, and recently bought my first place - so I've put some thought into the situation. The rent vrs buy thing is really just a simple EV calc imo.

If the interest only repayments on the mortgage are less than your current rent, it's probably +EV to buy.

Even if they are the same or slightly more on the mortgage, it's gonna become +EV pretty quickly when you factor in

A) Rent will increase with inflation, repayments generally won't, and

B) You earn profit on the entire value, verses only your cash if you were to invest elsewhere

That should never be the case if buying is +EV though. There will always be initial cost they you have to recoup, but once it's profitable you're better off compared to renting. There's no reason to be tied to a place for life imo.Originally posted by 5starpool View PostIf you buy now, you may not be able to afford to buy somewhere you'd actually like to live. If you meet someone, you might decide together you want to buy elsewhere, or move somewhere else. Of course you can sell and buy again, or rent it out, but while there is some merit to the 'dead money' thing, you are saddled in a lot of other ways, plus the savings you have built up have gone on deposit and furnishing, etc.

I bought this year, one of the main factors that made up my mind was that, even if I decided to move home in a near future, I could always cash in and turn a profit.

Comment

-

If you buy almost for the sake of it though, you lose your first time buyer status which allows more flexibility in terms of loan amount and some other benefits. Retrospectively, I think the freedom outweighs the benefits of owning unless you can but in some near ideal location.Originally posted by Mellor View Post- Short term, there will be ups and downs. But over any realistic timeframe, it'll be going up and up.

- Rent is dead money. But there's plenty of dead money in buying. Taxes and fees associated with the sale, interest on the mortgage, bills you might not have been paying before etc.

- Having a single income doesn't affect the EV, you'll just have less money to play with.

I'm by no means an expert, but I'm a similar age, and recently bought my first place - so I've put some thought into the situation. The rent vrs buy thing is really just a simple EV calc imo.

If the interest only repayments on the mortgage are less than your current rent, it's probably +EV to buy.

Even if they are the same or slightly more on the mortgage, it's gonna become +EV pretty quickly when you factor in

A) Rent will increase with inflation, repayments generally won't, and

B) You earn profit on the entire value, verses only your cash if you were to invest elsewhere

That should never be the case if buying is +EV though. There will always be initial cost they you have to recoup, but once it's profitable you're better off compared to renting. There's no reason to be tied to a place for life imo.

I bought this year, one of the main factors that made up my mind was that, even if I decided to move home in a near future, I could always cash in and turn a profit.

Comment

-

Myself and the little one got one each when we were heading to Ireland in July there. Hers was a Monsters Inc one and mine was your bog standard one they sell in airport. Hers was MUCH more comfortable. Since I am not a good flyer I tend to try and nap on a flight and I ended up pinching hers. Was much more comfortable.Originally posted by AndyFatBastard View PostPish. Get a neck pillow and never look back. There's a reason old people use those things so much. It's because they are god tier.

Comment

-

Rent isn't dead money, you're getting the use of something that's worth a few hundred k that you don't have to maintain or finance.Originally posted by Mellor View Post- Short term, there will be ups and downs. But over any realistic timeframe, it'll be going up and up.

- Rent is dead money. But there's plenty of dead money in buying. Taxes and fees associated with the sale, interest on the mortgage, bills you might not have been paying before etc.

- Having a single income doesn't affect the EV, you'll just have less money to play with.

I'm by no means an expert, but I'm a similar age, and recently bought my first place - so I've put some thought into the situation. The rent vrs buy thing is really just a simple EV calc imo.

If the interest only repayments on the mortgage are less than your current rent, it's probably +EV to buy.

Even if they are the same or slightly more on the mortgage, it's gonna become +EV pretty quickly when you factor in

A) Rent will increase with inflation, repayments generally won't, and

B) You earn profit on the entire value, verses only your cash if you were to invest elsewhere

That should never be the case if buying is +EV though. There will always be initial cost they you have to recoup, but once it's profitable you're better off compared to renting. There's no reason to be tied to a place for life imo.

I bought this year, one of the main factors that made up my mind was that, even if I decided to move home in a near future, I could always cash in and turn a profit.

Not sure straight rent vs buy calculators are meaningful. Renting offers a lot of freedom versus lumping your financial future into a illiquid asset with high transaction costs. Personally I'd rather put €€ into pension and other assets than tie myself to the local property market. Long-term I think there's got to be an improvement in construction, it's one of the few industries that hasn't had any productivity gains over the last few decades. With self-driving cars possible within our lifetime it should cut a lot of the Dublin premium out of the equation too. Building regulations need to change as well, builders are claiming they can't build apartments in the city for less than 300k?

It's much more of an emotional decision. I can understand wanting to put in improvements and set down roots in an area. I really doubt most homeowners put much thought into the financials. Has anyone ever heard anyone say "The bank offered us x but we only want to spend y?".

My friend is always telling me how the price of his house has gone up. Great, but what you gonna do with that paper profit? Much more envious of him making a proper home of it.Last edited by Denny Crane; 05-10-17, 11:29.

Comment

-

We're back baby!Originally posted by Keane View PostInteresting point.

The smart, ballsy guys are buying up property right now

Last edited by Denny Crane; 05-10-17, 11:08.

Comment

-

I'm already maxing my pension contributions and putting another ~15% of my gross into Degiro/company stock programs every month.Originally posted by Denny Crane View PostRent isn't dead money, you're getting the use of something that's worth a few hundred k that you don't have to maintain or finance.

Not sure straight rent vs buy calculators are meaningful. Renting offers a lot of freedom versus lumping your financial future into a illiquid asset with high transaction costs. Personally I'd rather put €€ into pension and other assets than tie myself to the local property market. Long-term too I think there's got to be an improvement in construction, it's one of the few industries that hasn't had any productivity gains over the last few decades. With self-driving cars possible within our lifetime it should cut a lot of the Dublin premium out of the equation too.

It's much more of an emotional decision. I can understand wanting to put in improvements and set down roots in an area. I really doubt most homeowners put much thought into the financials. Has anyone ever heard anyone say "The bank offered us x but we only want to spend y?".

My friend is always telling me how the price of his house has gone up. Great, but what you gonna do with that paper profit? Much more envious of him making a proper home of it.

Can't really go any higher with the taxable contributions due to cash flow so I'm a bit attracted by the idea of converting my monthly rent outgoing to something that would be potentially building value instead.

If I were to borrow ~120k for a ~150k apartment in the middle of Limerick at the moment over 20 years variable the repayment would be ~€300 per month lower than my rent is. Would probably have it paid back quite easily in less than ten.

Not sure what to do really :-/Last edited by Keane; 05-10-17, 11:13.

Comment

-

What's the first time buyer flexibility give you?Originally posted by 5starpool View PostIf you buy almost for the sake of it though, you lose your first time buyer status which allows more flexibility in terms of loan amount and some other benefits. Retrospectively, I think the freedom outweighs the benefits of owning unless you can but in some near ideal location.

Is it just 90% vrs 80% LVR. Or is there something else?

That might be a factor is you were to "waste" your FTB status on a very cheap showbox, and tried to move to a much more expensive place. But at long at you were looking at similar price brackets the equity from the first house counts towards the 2nd.

Plus second time buyers can get LVR exemption from banks much easier. 20% can be exempt, verses only 5% of first time buyers.

I've still no idea what my plans are. But I certainly don;t think I've lost any flexibility. Options to sell and cash in, or keep it as a renter.

Comment

-

No, jesus! I put X into indices (or is it indexes in this context?) on Degiro, then I get Y in bonuses every year that I can duck tax on by putting them into company stock for three years. The two amounts combine to ~15% altogether.Originally posted by Hitchhiker's Guide To... View PostKeane you madman, your putting 15% of your salary into your own employer's stock each month? Say it isn't so.

The minute any company shares vest they are whipped out and put in ind-exes/ices

Comment

-

we're now contemplating buying in London. ughOriginally posted by Hitchhiker's Guide To... View PostHas quantitative easing being affecting London house prices for the last 40 years?

This is a capital city phenomenon. Everyone wants to live where all the cool amenities are and that means most people in a country can't actually afford to live there. Thats not realistically changing.

Comment

-

Great for the bathroom tooOriginally posted by RichieM View Postdefinitely on the neck pillows, they are also pretty handy to have on holidays when reading on sun loungers"Gibney might be the greatest hero of our time." (Keane, 2012; Hitchhiker, 2017)

"Frank Gibney, he's my favourite ." (careca, 2012)

." (careca, 2012)

"Frank Gibney, he's my favourite." (mikeb, 2017)

Comment

-

it's very much the French model, and i'm always happy to up and go on a few months notice, but i suppose with a deposit from the Paris flat sale, plus the much lower exchange rate, the exhorbitant rental rates here, and kids in secondary school, wifey is starting to make a case that buying here may not be such a bad idea.Originally posted by Keane View PostYou were always the voice of balance with your 'rent for life' stuff!

add to that London is, for me anyway, the greatest city in the world, so a few years here whilst the kids finish school would be a pleasure (bar financially!!!)Last edited by shrapnel; 05-10-17, 11:47.

Comment

-

In general the cheaper a place is the more it swings towards just buying. If I lived outside Dublin and could get something like that I'd go for it. It may not be as applicable in Ireland as in the States/Canada, but people who buy rather than rent multi-mil gafs need their head examined.Originally posted by Keane View PostI'm already maxing my pension contributions and putting another ~15% of my gross into Degiro/company stock programs every month.

Can't really go any higher with the taxable contributions due to cash flow so I'm a bit attracted by the idea of converting my monthly rent outgoing to something that would be potentially building value instead.

If I were to borrow ~120k for a ~150k apartment in the middle of Limerick at the moment over 20 years variable the repayment would be ~€300 per month lower than my rent is. Would probably have it paid back quite easily in less than ten.

Not sure what to do really :-/

Comment

-

I've often considered whether I would buy or keep renting, it's just that in few years I may want to leave Ireland and it seems such a fucking hassle, plus I wouldn't be living in town like I am now, living in the city instead of travelling to get in is super happiness +EV and my rent for my apartment isn't too bad compared to most people.

Just seems like too permanent a thing but tempted as it would be lower than my rent. I am also happy not having to have any responsibility over anything, and it's all fixed for me and so on.

But...bigger place for less money...

I have a lot of money that I do not know what to do with, teach me your degiro ways.Originally posted by Keane View PostNo, jesus! I put X into indices (or is it indexes in this context?) on Degiro, then I get Y in bonuses every year that I can duck tax on by putting them into company stock for three years. The two amounts combine to ~15% altogether.

The minute any company shares vest they are whipped out and put in ind-exes/ices

Also maxing out your pension is surely a huge amount (guessing 20%), combined with 15% extra investment on top? 35% Gross a year seems like you wouldn't be up to much savings.

Surely a loan application would take all that into account too. Rent + 35% of gross gone leaves much less disposable.

What is the rule on maxing your pension? Like what if you are maxing it and your employer is matching some also?Last edited by Tar.Aldarion; 05-10-17, 11:59.

Comment

-

Getting use of it doesn't exclude it from being dead money.Originally posted by Denny Crane View PostRent isn't dead money, you're getting the use of something that's worth a few hundred k that you don't have to maintain or finance.

Renting or buying a car for private use is dead money. But you still get to use the car in both cases.

To be clear, I consider dead money to be anything that with no return. Almost most things we buy are dead money. I'm not just rolling out the "rent is dead" line. There's dead money in buying.

As I said above, my view might be coloured by living in a very different market. But I don't see any loss in flexibility. If I decide Sydney is not for me, I could pack up and go home and get a tenant to pay my mortgage.Not sure straight rent vs buy calculators are meaningful. Renting offers a lot of freedom versus lumping your financial future into a illiquid asset with high transaction costs.

Personally I'd rather put €€ into pension and other assets than tie myself to the local property market.

There's a compulsory 10% employer pension in australia. Don't think there's a need anto load any more in at this stage - heavy penalties for early exits.

Globally, construction technology has come on massively in the last 30 years. Ireland has typically be slow to utilise them though. The building regs are only going to get tighter, not looser. It's planning that's crippling Dublin, not regs. Add more stories to a building, you offset the costs of stair cores, foundations, lifts, and of course land prices. Restrict the height, and the unit costs goes up.Long-term too I think there's got to be an improvement in construction, it's one of the few industries that hasn't had any productivity gains over the last few decades. With self-driving cars possible within our lifetime it should cut a lot of the Dublin premium out of the equation too. Building regulations need to change too, builders are claiming they can't build apartments in the city for less than 300k?

This I agree with. People get to a certain age and think buying a house is the done thing. It's the same with getting married or having kids. Lots of people have kids because they are supposed to.It's much more of an emotional decision. I can understand wanting to put in improvements and set down roots in an area. I really doubt most homeowners put much thought into the financials. Has anyone ever heard anyone say "The bank offered us x but we only want to spend y?".

My friend is always telling me how the price of his house has gone up. Great, but what you gonna do with that paper profit? Much more envious of him making a proper home of it.

Buying an unit on the other side of the world certainly wasn't an emotional decision for me. Purely financial. I liked the place I was renting, renting long term is much more feasible out here. But doing the numbers, it was fairly obvious I was already paying a mortgage, just not my own. I'd guess you're right and most people don't look into the financials. But most people are idiots. We were approved for much more than we wanted, but there's no 3.5x rules here

Before buying, I looked at lumping in into a term deposit instead. The best deals weren't getting close to even a lowball market growth estimateOriginally posted by Keane View PostInteresting point.

Comment

-

We are so back.Originally posted by Mellor View Posteven if I decided to move home in a near future, I could always cash in and turn a profit."Gibney might be the greatest hero of our time." (Keane, 2012; Hitchhiker, 2017)

"Frank Gibney, he's my favourite ." (careca, 2012)

." (careca, 2012)

"Frank Gibney, he's my favourite." (mikeb, 2017)

Comment

-

I keep about 6k in an instant access savings account at the moment in case of emergencies. Would like to get this up to ~10k but that is about the most I would want to have sitting idle at the moment.Originally posted by Tar.Aldarion View PostI have a lot of money that I do not know what to do with, teach me your degiro ways.

Also maxing out your pension is surely a huge amount (guessing 20%), combined with 15% extra investment on top? 35% Gross a year seems like you wouldn't be up to much savings.

Surely a loan application would take all that into account too. Rent + 35% of gross gone leaves much less disposable.

What is the rule on maxing your pension? Like what if you are maxing it and your employer is matching some also?

Re:index investing/degiro - read this http://jlcollinsnh.com/stock-series/

So yeah, I put 20% of my gross into my pension. Company contributes a further 8%.

Your contribution is capped (in terms of tax benefits) at 15% up to age 30, 20% up to I think 40 etc. Your contribution does not include your employer's contribution, i.e. I personally can get tax relief on 20% despite company putting in 8%.

After that, I put roughly another 15% (calculated on the gross) into degiro and company stock (tax incentivised) options. I'm just calculating the extra % from the gross because it's easier. The Degiro money is just from my pay packet every other week, it's been taxed and is free for me to do with as I please. The company stocks are tied up for a while but the tax relief is worth it.

I can stop putting money into Degiro if I need more cash flow, withdraw what's in there if I need a lump sum etc although I don't envisage doing that. I can adjust my pension contribution whenever I like as well so again if I need a bigger pay packet I have ~16% gross to add in with ~2 weeks' notice if necessary.

As it stands we pay 475p/m in rent each and live very comfortably on what's left in terms of socialising, holidays etc. Max mortgage I would be looking at would only come in at ~950p/m so would not be a big change once everything was sorted.Last edited by Keane; 05-10-17, 12:22.

Comment

-

The building regs are only going to get tighter, not looser. It's planning that's crippling Dublin, not regs. Add more stories to a building, you offset the costs of stair cores, foundations, lifts, and of course land prices. Restrict the height, and the unit costs goes up.

.Six-storey buildings are the optimal solution for high-density apartments and anything more adds “substantial structure, fire preliminaries and finance costs”. There should also be a “higher ratio” of one- and two-bed apartments.

This can't be normal can it?

15% under 30, 20% under 40, capped at 115k of earnings.Originally posted by Tar.Aldarion View Post

What is the rule on maxing your pension? Like what if you are maxing it and your employer is matching some also?Last edited by Denny Crane; 05-10-17, 12:46.

Comment

-

Thanks for the input everyone, I think pretty much every thought I've had on this (but with more in depth work done on the calcs) has been laid out somewhere.

I think there's definitely an existential crisis that occurs in the late 20s / early 30s where these big existential decisions start looming into the picture. Last night alone I found myself looking at jobs, savings plans and houses, despite the fact I'm happy enough with where I work and where I live (my savings are earning some pitiful amount of interest that urgently needs to be addressed).

On the one hand I'm definitely lucky that there are no external forces really pushing me into any of these major decisions, but on the other hand that almost makes it more difficult - left at the mercy of my own initiative.

Comment

-

There's some considerations around tax issues specific to Ireland so come back before you dump a wad anywhere.Originally posted by Tar.Aldarion View PostAh I see, your rent is grand! Mine is way more, plus no splitting bills etc. Seems pretty decent, might put up my pension more, not sure, it's 10% matched atm but bonus' don't go into it so realistically it's less than 10%.

Will read that stock series cheers!

Comment

-

Stay strong brother. We are in the same mental space Carlo.Originally posted by carlop View PostThanks for the input everyone, I think pretty much every thought I've had on this (but with more in depth work done on the calcs) has been laid out somewhere.

I think there's definitely an existential crisis that occurs in the late 20s / early 30s where these big existential decisions start looming into the picture. Last night alone I found myself looking at jobs, savings plans and houses, despite the fact I'm happy enough with where I work and where I live (my savings are earning some pitiful amount of interest that urgently needs to be addressed).

On the one hand I'm definitely lucky that there are no external forces really pushing me into any of these major decisions, but on the other hand that almost makes it more difficult - left at the mercy of my own initiative.

My missus has owned her gaf since she was 24, 29 now. I think I lucked out cos it gives me a bunch of more options... for now. She has also just bought into a company that opens and runs bars around Calgary.

Maybe I can be a kept husband. Play golf.This may or may not be an original thought of my own.

All efforts were made to make this thought original but with the abundance of thoughts in the world the originality of this thought cannot be guaranteed.

The author is not liable for any issue arising from the platitudinous nature of this post.

Comment

-

If you are going to buy a house, do it now. Dublin is about to go supernova. Finding the right place, winning a bidding war and completing the sale will take months and months unless you're incredibly lucky."I can’t find anyone who agrees with what I write or think these days, so I guess I must be getting closer to the truth." - Hunter S. Thompson

Comment

-

If it's going to be a relatively full flight, don't do the silly thing and book a seat in an empty row of 3. If someone is on the outside, book the inside or vice versa depending on your preference. You've a 73% more chance that the middle seat will remain empty than if you booked an empty row.Originally posted by oleras View PostSeat selection.

I booked flight to Koh Samui.

4 flights with 2 planes, 3 legs on the 777-300 and 1 on the A380.

The twin seats near the rear of the 777 seem the optimum, but last for the food, obv paying a premium to not have to talk to anyone.

On the A380 we can go upstairs, again, twin seats.

I could just wait till 48hrs before and take the free allocation, but don't want to end up in the middle of the middle row !

What are peoples personal preferences ?

I'm defo more of a window man because you can be sure that the second you close your eyes on an aisle seat, someone will want to get out for a piss. If you're right handed, sit on the right side so that if using a phone/tablet, you're not elbowing mr middleman in the ribs!

Somewhere in that ballpark is good! My flights to/from Dublin next month are 24F, 25FOriginally posted by Tar.Aldarion View PostI sit in 26f, it's the best seat.

Comment

-

It's bladerunner 2049 time and I'm hyped!

Before you see it there are three shorts between the original film and the new one (which is 30 years later). The director got people he admired to make them:

Welcome to 2036. Niander Wallace introduces his new line of replicants. Watch now. #BladeRunner2049, in theaters October 6.--Thirty years after the events of...

Welcome to 2036. Niander Wallace introduces his new line of replicants. Watch now. #BladeRunner2049, in theaters October 6.--Thirty years after the events of...

Journey into the world 2049 with a replicant on the run. Dave Bautista is Sapper Morton. #BladeRunner2049, in theaters October 6.--Thirty years after the eve...

Journey into the world 2049 with a replicant on the run. Dave Bautista is Sapper Morton. #BladeRunner2049, in theaters October 6.--Thirty years after the eve...

In 2022, an EMP detonation has caused a global blackout that has massive, destructive implications all over the world. Directed by Cowboy Bebop and Samurai C...

In 2022, an EMP detonation has caused a global blackout that has massive, destructive implications all over the world. Directed by Cowboy Bebop and Samurai C...

Originally posted by Flushdraw View Post

Somewhere in that ballpark is good! My flights to/from Dublin next month are 24F, 25F

Comment

-

My GAA club at home has made it into the last 3 to win a new scoreboard and clock for the club. All you have to do is like a picture please. We're in the lead anyway but would like to stay there. Thanks to anyone that does.

The fella that does the grounds keeping brought his son to help put out the flags before a county league game.

SPOILER

Comment

-

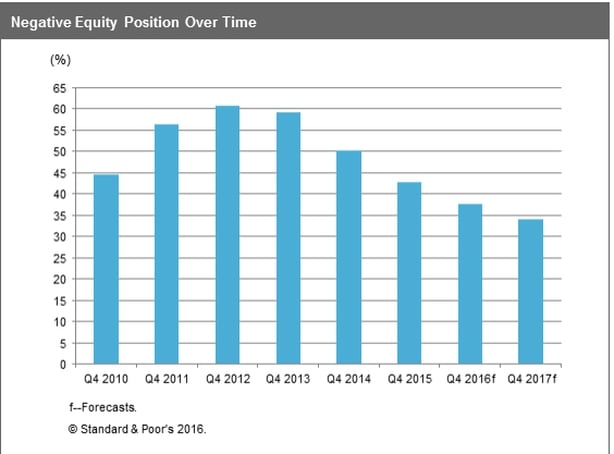

Are you asking what the prospect ending up with negative equity has to do with buying in the middle of what some see as a property bubble?Originally posted by Hitchhiker's Guide To... View PostWhat's that got to do with now?!

Plus the number is evidently wrong. There's only 100,000 homes in negative equity which is far less than 35% of mortgages.

S&P clearly don't know how to forecast (your chart is forecasts made in the past), which is the shocker of the century.Happiness is not a goal; it is a by-product. ~Eleanor Roosevelt

Comment

-

I have always zoned out when watching the original Bladerunner. I am generally a fan of good Sci-Fi but I it seems I have switched off when watching it as I am pretty sure I have seen the start 4/5 times but couldn't tell you much more if anything about what happens. Must try give it another watch as will probably give the new one a spin in the cinema.

Opr

Comment

-

Just regular folk.Originally posted by Hitchhiker's Guide To... View Postand just for the sake of it, who thinks we're in the middle of a property bubble so i can put them on my stupid list?

The poll of 1,000 adults by Accuracy Market Research found that almost two-thirds (64%) of all adults believe we are in the middle of a housing bubble.

The survey also found that nearly half of all Irish adults (47%) are concerned that house prices will crash.Happiness is not a goal; it is a by-product. ~Eleanor Roosevelt

Comment

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/YY4MF5M3F54VF2BMQT5J2D4V2A.jpg)

Comment